Subject QuickStart

![]()

The QuickStart page has been redesigned to mirror “sale records” in DataLog. This enables ClickForms synchronization for:

- saving a “sale” as “subject”, or

- saving “subject” as a “sale” as shown on the top left cell (currently blank)

This new page eliminates entering information in the middle of the appraisal process (cost, income and sales comparison approaches) for the subject that was not captured in prior versions. However, there is a new challenge because of the subject to sale feature when cloning an old appraisal and merely inserting the new Subject QuickStart page. While it appears to be a simple task, its more complicated behind the scenes --- but it only happens once when moving from the old QuickStart to the new Subject QuickStart because of cells that were added and/or removed. Thus, AgWare recommends, for the first time, when cloning an old appraisal for a new subject, follow this sequence:

- Begin with a new container and insert the old “filled out” Subject QuickStart page, then

- Insert the new Subject QuickStart page, then

- Open the old report and drag all the desired pages (which could be all pages excepting the old QuickStart page) into the new container.

CAUTION: The information in your report or contain is dominant, i.e., if you have a container already populated with either a "Classic" or "New" QuickStart page --- then put new information in ---- that new information will be populated with the old or original information in the report. THEREFORE, insert the new subject information into the report FIRST to population the description and and approach pages.

After the new Subject QuickStart page is inserted into the new appraisal, then dragging or cloning only the new page between containers will work because all the cells are the same.

There is are several new fields (red and purple boxes); and one important cell moved (Eff. Date (black box)). The “Customer Name” which could be lender, client, or something else. The purple box is for the subject’s latitude and longitude for geo-referencing (distance in some of AgWare’s programs). The "Location" entry many seem slightly more compliciated, but the mere statement of SW 15 mi. means something to the valuer but many not assist the reader or reviewer --- depending on their knowledge of the area. The rating (Ave 3.0 (on a scale of 5)) may help the presentation and visual differences between the sales and subject.

The green box identifies the subject’s variable fields --- just like each sale. Those fields are “type-ahead” fields like those used in the approaches or display grids.

Since the fixed fields contain “City”, “County”, “State”, “Sec/Twp/Rge”, there is no real need to place the miles from the same city, or miles from some other landmark in the “Location” field. Creative answers neutralized the search features in DataLog. In this example, “Ave (3.0)” is displayed in the Sales Comparison Grid for its “Location”. Ave “3.0” is a “user-defined” rating to enable the reader (usually a non-appraiser”) to quickly observe the “degree of separation” between the sales and subject within any of the appraisal approaches.

Legal Description: The legal description is a 5-line comment field. It does NOT transfer to any other pages within ClickForms --- because it is a comment field. The users should include a picture of the assessment legal, enter a page and label that "Legal Description" or copy/paste the QuickStart description in your narrative --- or a place of your choice.

AgWare’s 2020 Case Study uses a zero (0) through five (5) ranking system merely as a suggestion that should be synchronized with the highest and best use category:

5.0 = Best, or Excellent

4.0 = Above Average, or Good

3.0 = Average

2.0 = Below Average, or Fair

1.0 = Poor

0.0 = None

It is noted, if the HBU changes, the rating for some elements may change or have a different market impact. If the HBU is rural residential, "good access" may be rated differently within the market than a farm, ranch, or mixed agricultural property. Some states may have "legal provisions" for access, some do not. The simply means that in some states where legal access is not automatically provided by state law or regulation, the market may have some impact on that legal situation.

AgWare's tutorials on the website demonstrates the use of these elements in the Sales Comparison Approach.

Land-Mix and the ER Factor

The land mix chart has only been “re-spaced” with separation between the “deeded acres” portion on the left, the “Unit section” in the center and the last column shown as “equivalent units”. As for earlier versions, the left side of the land-mix grid is for deeded units. The middle (yellow box) is and has always been for converting the deeded units to some other “effective unit” standard, e.g., AUs/AUMs, mbf, or non-deeded elements that are part of the total land contribution. The numbers in the green box are the “first call” on the “sale prices just like in DataLog”, and takes precedence over what is shown in the “Acre” breakdown (price allocated after the "units" and value assigned are subtracted first). If you have questions concerning the use of “Units” please call or email ---- most appraisers or data analysts will use acres and will not applied “Units”.

The subject equivalent units (yellow box) can ONLY be derived from ratios and are part of the final ER Factor calculation (red box). In this example, the Subject’s ER Factor of 78.05% means its composition is something less than 100% because there are inferior land types that contribute less ($/Acre) than Cropland 1 (the data standard for the market area). ASFMRA textbooks and courses are source and provided the basis for this procedure. Additional “Help” sections are available on the Website.

Sales have multiple ways for the ER computation (see the “Help” tab on AgWare’s Website (uaar.net), then move from Help to DataLog). The second page of the “Help” articles includes “3 Ways to Compute ER”. Briefly, the ER Factor is a mathematical expression of each property’s land-mix. There is a very simple benefit, the ER procedure replaces the entire “land-mix” calculation atop each “Sale Adjustment Worksheet” page --- a process that could take up to 80 to 100 calculations per sale using the original procedures.

The ER Land Use and ER Factor for the subject are shown (red box) and required to compute the land-mix adjustments in accordance with the sales. The subject must be assigned ratios for all components for the ER procedure to be used.

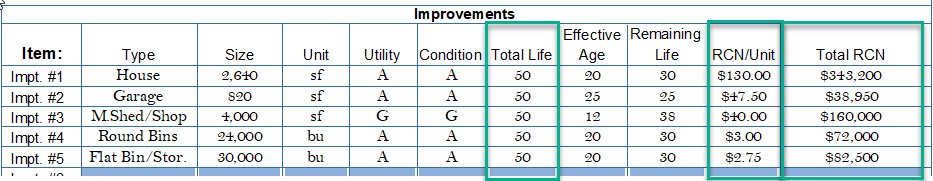

Improvements

The improvements are now inventoried horizontally, rather than vertically. Former unused elements such as construction, foundation, roof, floor, and exterior have been eliminated because they never transferred into the subject’s description or approach pages.

The green boxes are new entries for the Subject’s QuickStart page. Only five (5) of potentially twenty (20) buildings can be displayed. If more than twenty buildings exist, attempt to group similar buildings by age and type, or craft in a spreadsheet and import that image.

Once the total life and effective age are entered, the remaining life is computed. The RCN/Unit is entered building-by-building, the total RCN is computed and transferred into the cost approach.

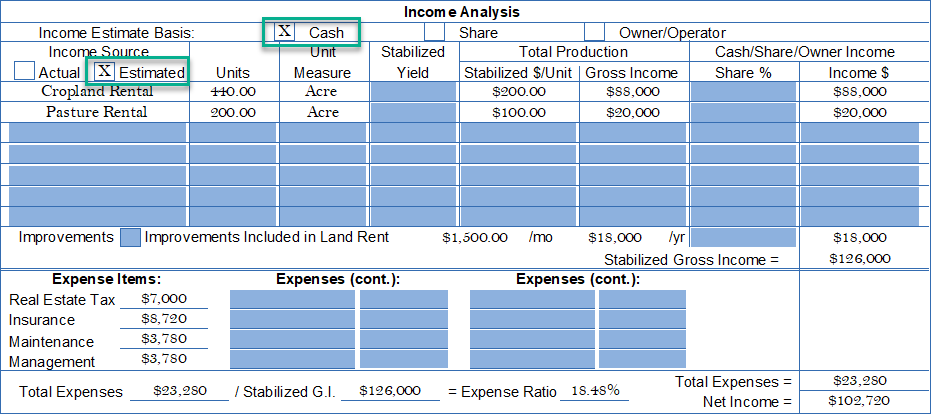

Income Approach

The Income Analysis has not changed. Note, “Estimated Cash” bases were checked (green boxes). If “share” or “owner/operator” are used, the remaining blank fields in the example will have to be filled accordingly. All sales and subject should be analyzed on the same income basis. There are four fixed expense categories with eight (8) more variable fields in two columns.

Programming Note: The gross income calculation in the Classic Forms is narrower, i.e., when the Cash basis is identified, the components within the calculation are:

Cropland 1: 440 acres X $200/Unit (acres) = $88,000

When using Share or Owner/Operator, the income involves the "business of agriculture" or includes and management decisions beyond that experienced by just "cash" rental. Hence, "Yield and Share %" become part of the calculation will accelerated Management Expenses (yellow box) due to active involvement by the owner with the tenant in production decisions. The user should used the same income basis for the sales and subject.

Cropland 1: 440 acres X Stabilized Yield X $/Yield-Unit X Share % (shown in red).