2032-A IRS Ag Valuation

![]()

IRS: 2032-A Special-Use Agricultural or "Alternate" Valuation

The "2032-A" procedure was originally passed in 1976 as defined by IRS in 26 U.S. Code §2032.A to help protect agricultural land from estate taxes based on "use value" rather than Market Value. The goal was assist rural agricultural families and associated businesses to manage their tax liability upon death of a family member. Without this tool, the estate tax on agricultural land regularly surpasses the property's ability to repay that amount across any realistic time-frame.

The appraiser should engage an attorney and accountant for the process since there are legal requirements for evoking 2032-A procedures. Two (2) appraisals will be required within the Scope of Work (SOW), i.e., one without the special rules and the second with the 2032-A formula to measure the tax savings. The result is the land owner subjugates the property to recovery of the "tax savings" plus penalties, if the conditions of the Code are compromised.

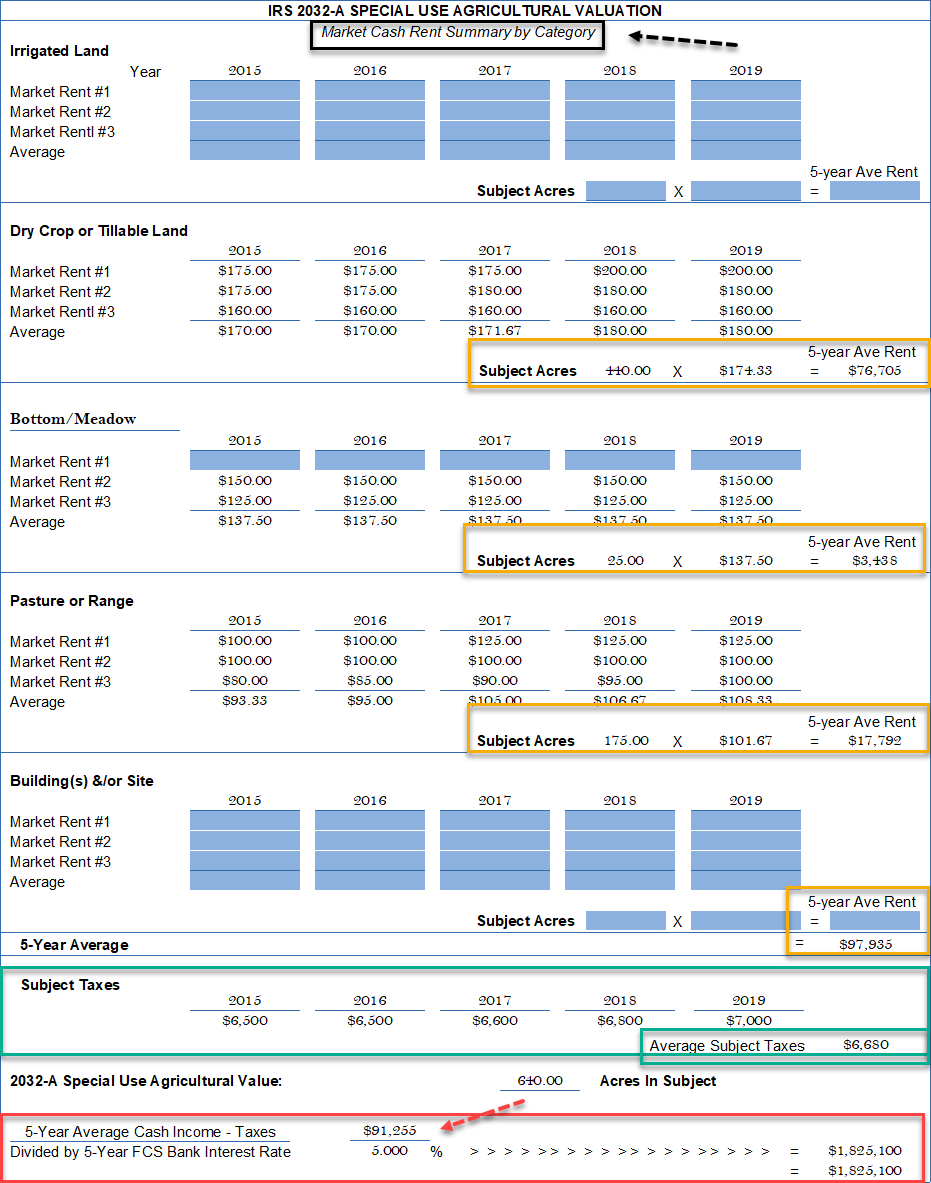

The IRS formula was defined to reflect "use-value" as:

- Annual "Gross" Income is computed from the last 5-year annual cash rental average

- Less: the average 5-year real estate taxes (the only expense allowed),

- Capitalized by the 5-year annual Farm Credit Services (FCS) mortgage rate in the state where the subject is located.

The process involves documenting "rental comparables" for five years preceding the date of death, subtracting the subject's prior 5-year average real estate taxes, then divided by the published FCS's rate for the 2032-A procedure. The valuer can source that mortgage rate on-line by searching the 2032-A rate --- say for March 1, 2020 and find something like:

OR:

Ag-Ware originally crafted a summary page in the 1990's to comply with the 3032-A tax code by "land category". It has be revised slightly over time, but the basic concept has remained the same. The hypothetical subject contains 440 acres dry cropland, 25 acres bottoms/meadow, and 175 acres pasture.

Cash rentals (yellow ) must be documented for the 5-year period preceding the date of death and averaged by year. Note: DataLog can be used to document and/or store cash leases. Mark the record or check-box as a lease. Ag-Ware recommends the user make a statement in the comments regarding lease terms, rates, escalations over time, termination, etc. For now, the "grantor/grantee" labels remain, but future versions will convert those to Lessor/Lessee when the "lease" check-box is marked.

The subject's 5-year average gross income is shown in the last yellow box below at $97,935.

The 5-year average of the subject's real estate taxes are shown in green, with the final tax subtraction of $6,680. This results in the proper "adjusted" net income for the special-use calculation at $91,255. The subject is located in AgriBanks locale with a rate of 4.68%; however, the demonstration shows 5% for this hypothetical example.